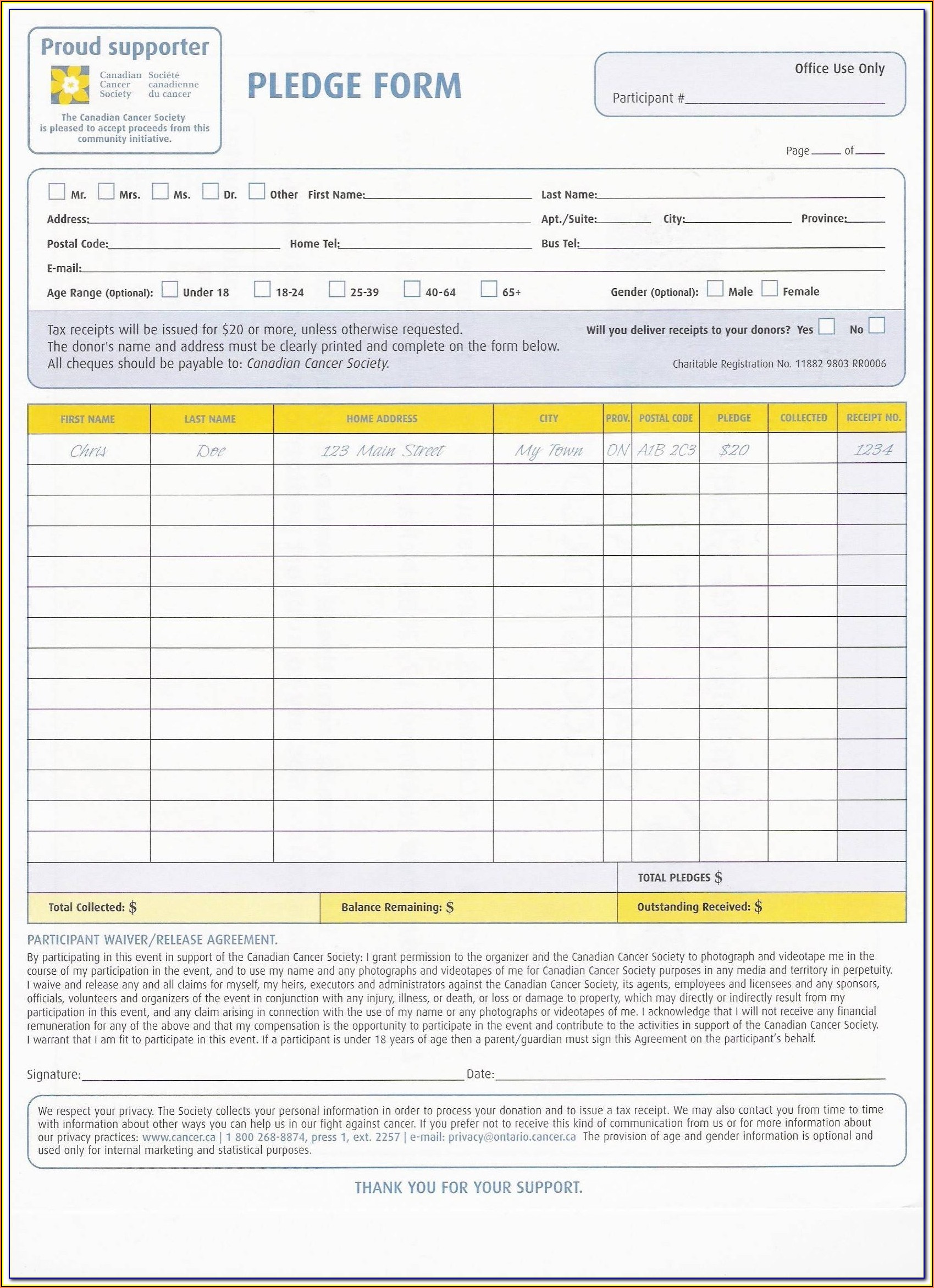

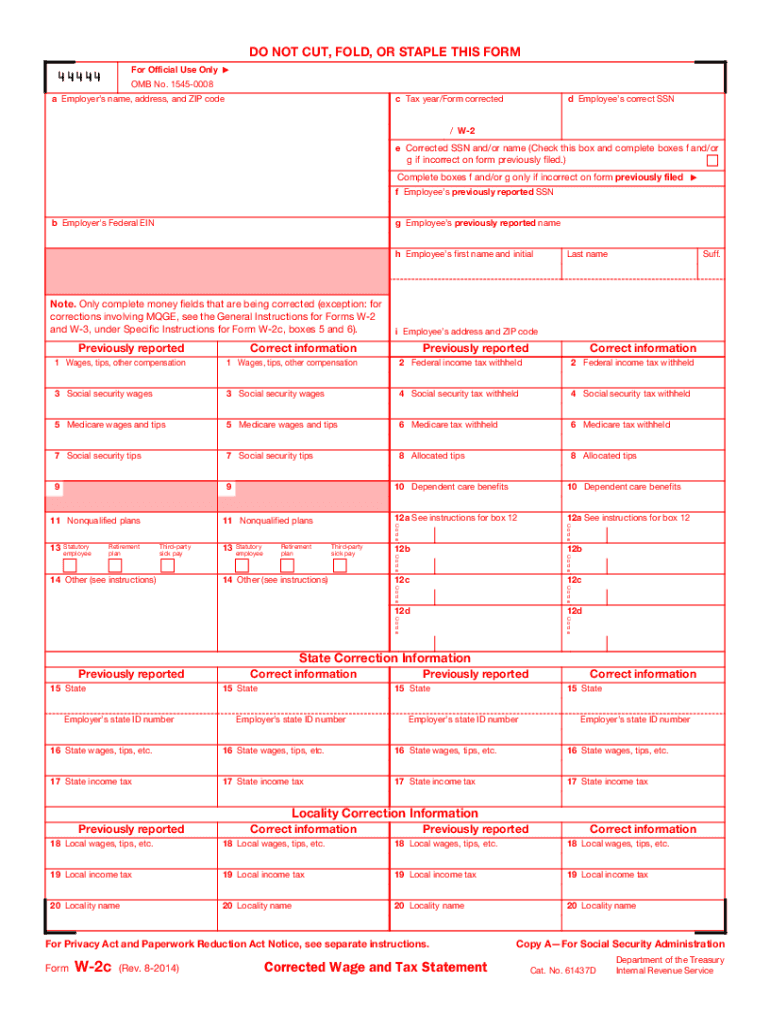

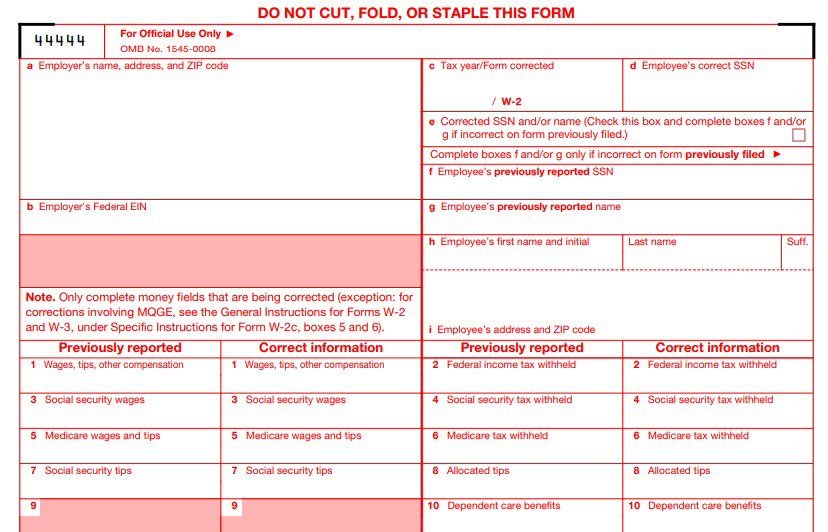

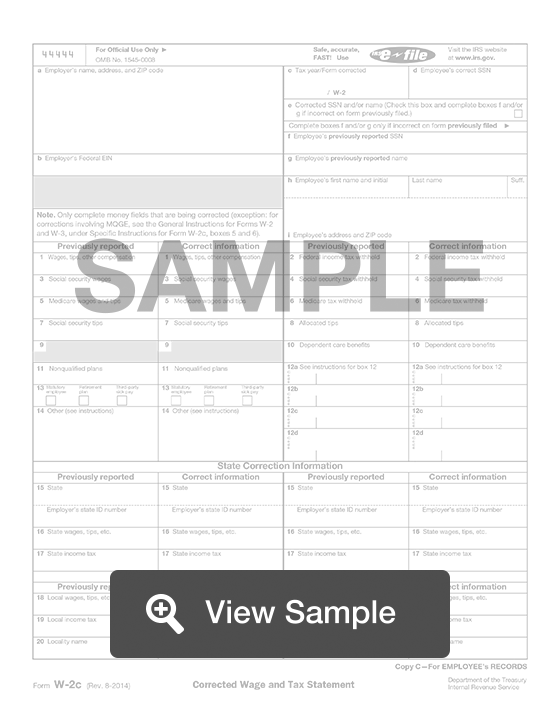

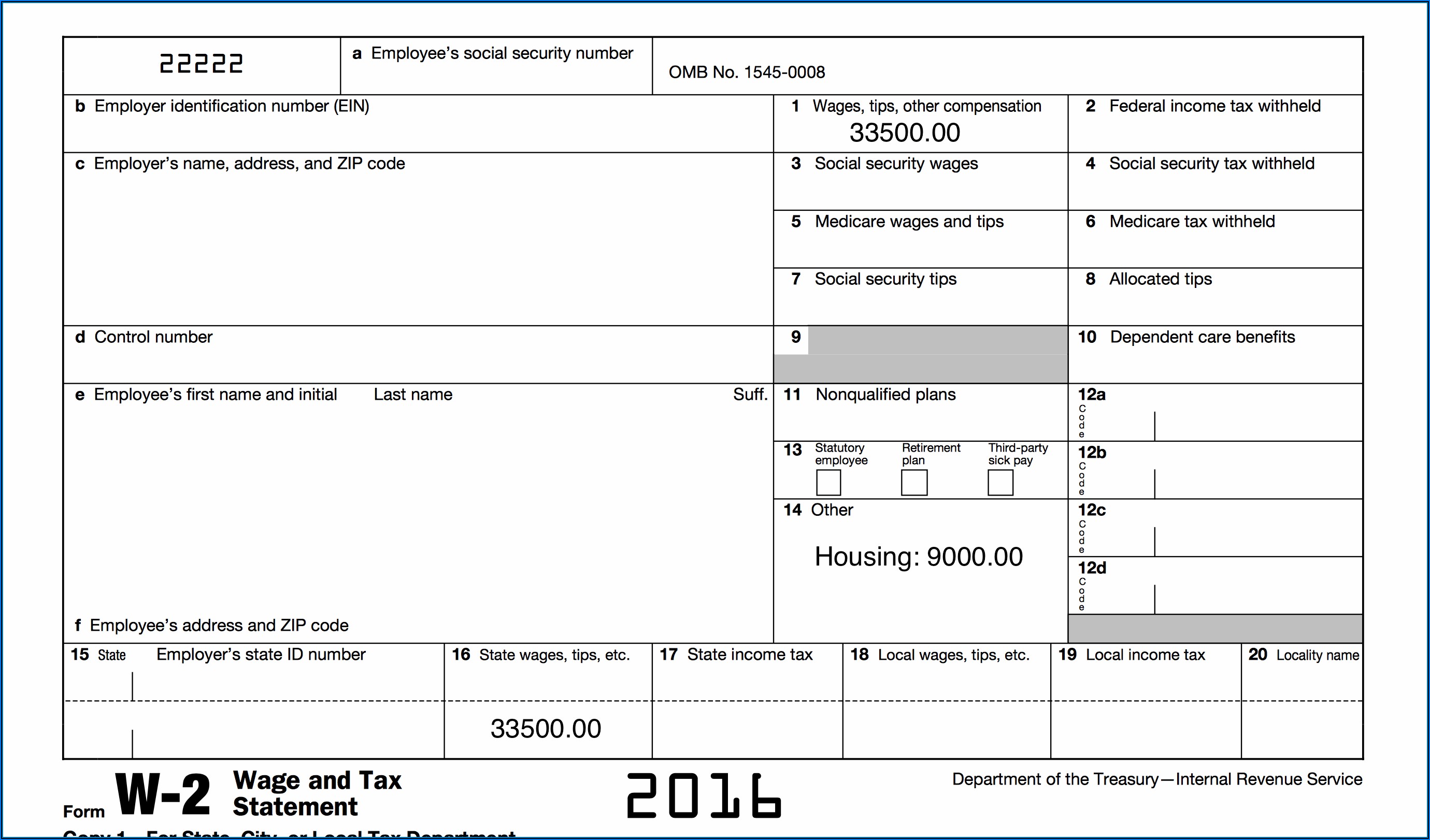

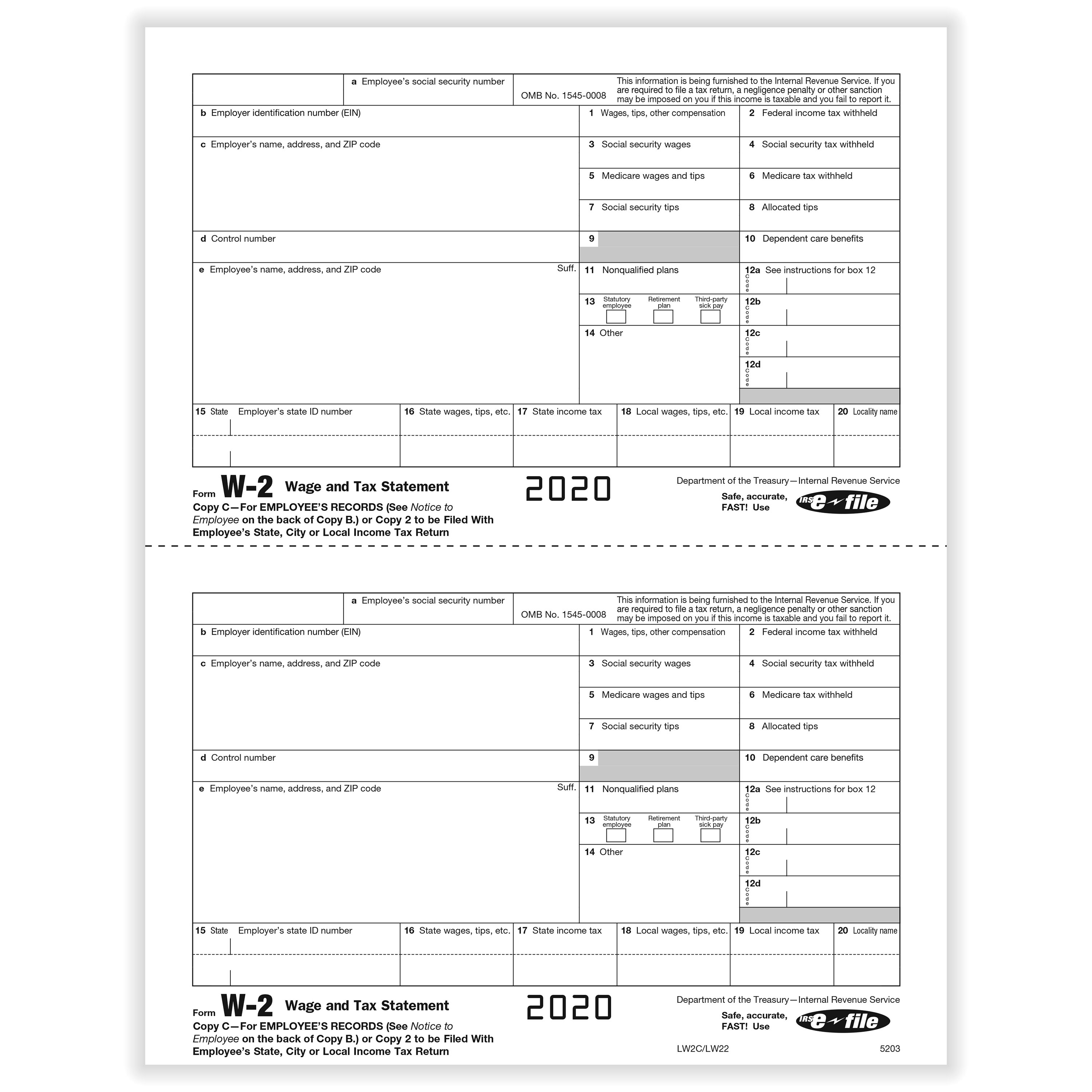

W2C Printable Form

W2C Printable Form - I got a w2c after i already filed my taxes. How do i amend this? Do i need to file this w2c this year or can i file this w2c in the next tax year ?i filed taxes.missed a w2.it had wrong social number.one. Also i got my meta w2 after i filed the amount i received under other income. Do i need to amend tax return as i got w2c from employer? I was using the previously reported information to report his taxes via turbotax as i have in the past. I received a w2c for my 2022 taxes from adp which says my previously reported wages were corrected and increased by $38k, and my federal income. Now i got w2c form for 2023 from my employer and. I worry that if i use the w2c. My son passed away in january and i was filling out his taxes. I already filed tax return in march 2024 and got accepted. How do i amend this? I worry that if i use the w2c. My son passed away in january and i was filling out his taxes. Do i need to file this w2c this year or can i file this w2c in the next tax year ?i filed taxes.missed a w2.it had wrong social number.one. Now i got w2c form for 2023 from my employer and. I was using the previously reported information to report his taxes via turbotax as i have in the past. Also i got my meta w2 after i filed the amount i received under other income. The w2c is for sure less than the original w2 and thus the fed and state taxes she paid are higher than what is reflected on the w2c. Do i need to amend tax return as i got w2c from employer? I was using the previously reported information to report his taxes via turbotax as i have in the past. How do i amend this? I worry that if i use the w2c. The w2c is for sure less than the original w2 and thus the fed and state taxes she paid are higher than what is reflected on the w2c.. Now i got w2c form for 2023 from my employer and. I received a w2c for my 2022 taxes from adp which says my previously reported wages were corrected and increased by $38k, and my federal income. I worry that if i use the w2c. How do i amend this? Also i got my meta w2 after i filed the. I received a w2c for my 2022 taxes from adp which says my previously reported wages were corrected and increased by $38k, and my federal income. I was using the previously reported information to report his taxes via turbotax as i have in the past. Also i got my meta w2 after i filed the amount i received under other. I got a w2c after i already filed my taxes. Now i got w2c form for 2023 from my employer and. I worry that if i use the w2c. I already filed tax return in march 2024 and got accepted. Also i got my meta w2 after i filed the amount i received under other income. I already filed tax return in march 2024 and got accepted. I received a w2c after i filed my taxes. I got a w2c after i already filed my taxes. My son passed away in january and i was filling out his taxes. I worry that if i use the w2c. How do i amend this? The w2c is for sure less than the original w2 and thus the fed and state taxes she paid are higher than what is reflected on the w2c. Now i got w2c form for 2023 from my employer and. Do i need to amend tax return as i got w2c from employer? My son passed. My son passed away in january and i was filling out his taxes. I received a w2c after i filed my taxes. Do i need to file this w2c this year or can i file this w2c in the next tax year ?i filed taxes.missed a w2.it had wrong social number.one. How do i amend this? Do i need to. Do i need to file this w2c this year or can i file this w2c in the next tax year ?i filed taxes.missed a w2.it had wrong social number.one. The w2c is for sure less than the original w2 and thus the fed and state taxes she paid are higher than what is reflected on the w2c. I already filed. I received a w2c after i filed my taxes. Do i need to amend tax return as i got w2c from employer? How do i amend this? I got a w2c after i already filed my taxes. I worry that if i use the w2c. I received a w2c for my 2022 taxes from adp which says my previously reported wages were corrected and increased by $38k, and my federal income. My son passed away in january and i was filling out his taxes. I was using the previously reported information to report his taxes via turbotax as i have in the past. The w2c. Also i got my meta w2 after i filed the amount i received under other income. I received a w2c after i filed my taxes. Now i got w2c form for 2023 from my employer and. The w2c is for sure less than the original w2 and thus the fed and state taxes she paid are higher than what is reflected on the w2c. My son passed away in january and i was filling out his taxes. How do i amend this? I worry that if i use the w2c. I was using the previously reported information to report his taxes via turbotax as i have in the past. Do i need to amend tax return as i got w2c from employer? I received a w2c for my 2022 taxes from adp which says my previously reported wages were corrected and increased by $38k, and my federal income.Fillable Form W 2c Printable Forms Free Online

Form W2c Fill In Version Form Resume Examples

Fillable W2c Form Printable Forms Free Online

W2c form 2019 Fill out & sign online DocHub

W2c Online Fillable Form Printable Forms Free Online

Fillable Form W2c Printable Forms Free Online

Printable W2C

W2c Printable Form Printable Forms Free Online

W2c Online Fillable Form Printable Forms Free Online

Printable W 2 Form Printable Forms Free Online

Do I Need To File This W2C This Year Or Can I File This W2C In The Next Tax Year ?I Filed Taxes.missed A W2.It Had Wrong Social Number.one.

I Got A W2C After I Already Filed My Taxes.

I Already Filed Tax Return In March 2024 And Got Accepted.

Related Post: