Form 1099 Misc Printable

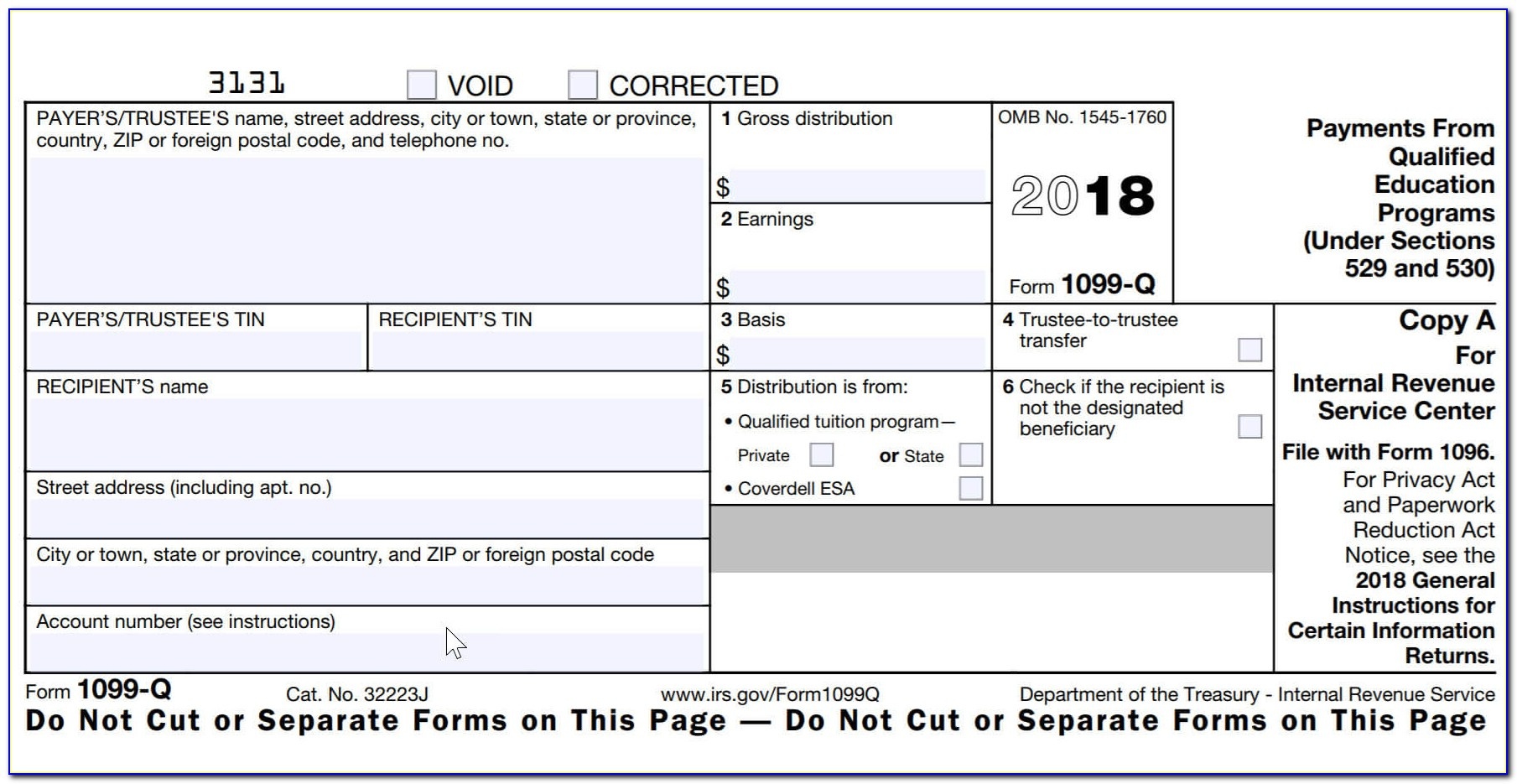

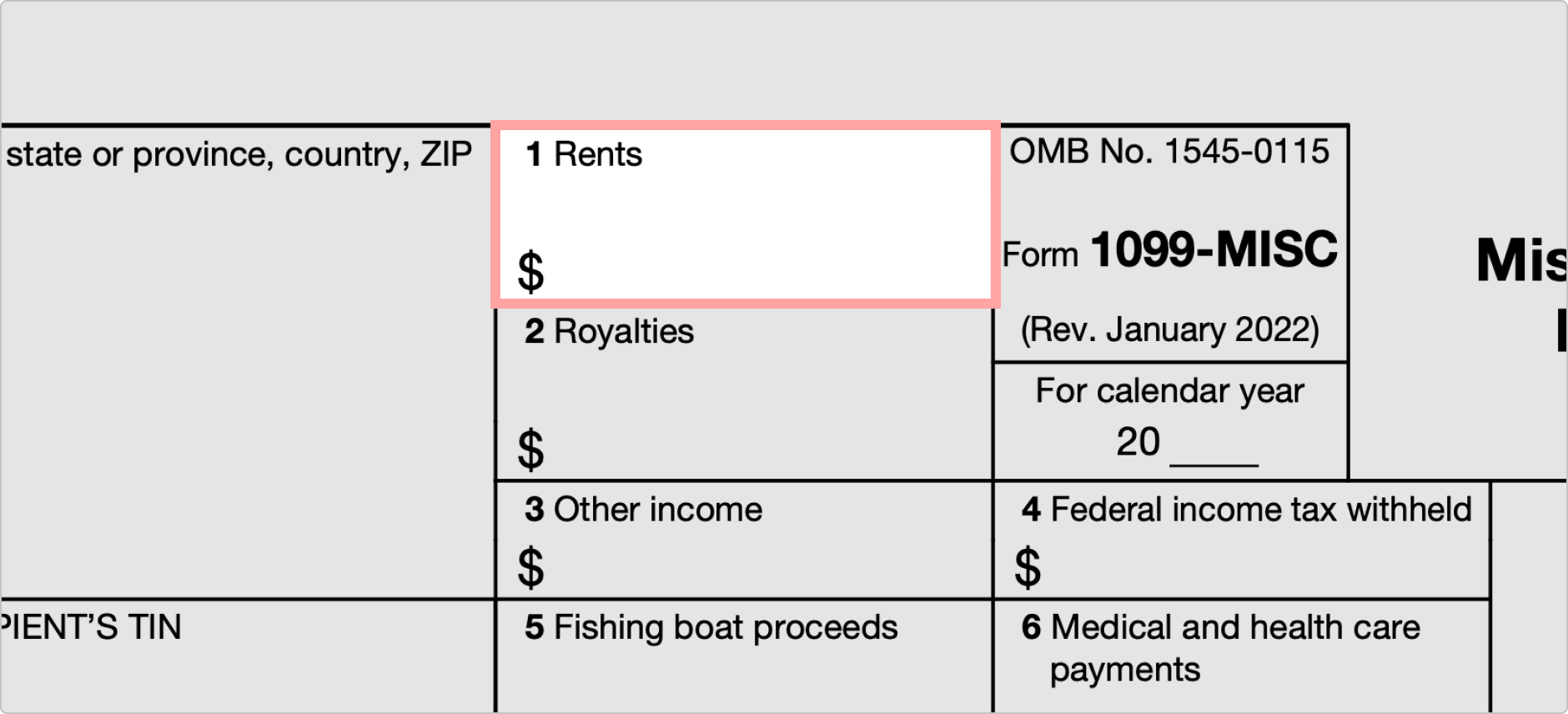

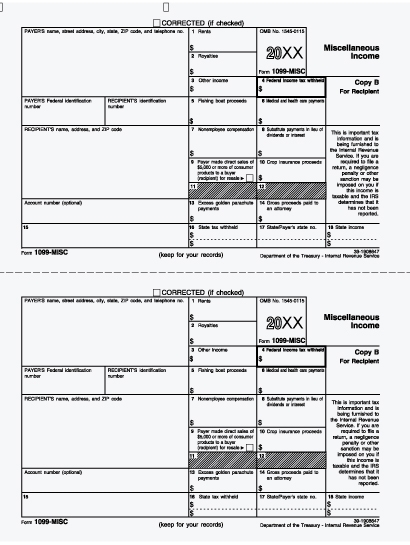

Form 1099 Misc Printable - What in the world could be the hold up with these simple forms? I have the official irs red forms that i need to print only the information that i entered. Yes, your contractor can file copy b. It was a class action lawsuit and received no 1099 forms whatsoever. On a tuesday.big deals are here.welcome to prime daydeals of the day Everything looks correct, however when i go to print the forms off there is no copy 2 that. It was due january 31, 2020. The sooner you file the better. If you are an employee, then your employer should have treated these reimbursements differently. No, you still should file copy a along with form 1096. Per the irs, and this is for employers to follow, do not use form. On a tuesday.big deals are here.welcome to prime daydeals of the day What in the world could be the hold up with these simple forms? I tried to put it in the misc section but it asks for a federal id number for the payee but i dont have one. It was a class action lawsuit and received no 1099 forms whatsoever. No, you still should file copy a along with form 1096. It was due january 31, 2020. I have the official irs red forms that i need to print only the information that i entered. If you are an employee, then your employer should have treated these reimbursements differently. Yes, your contractor can file copy b. What in the world could be the hold up with these simple forms? Yes, your contractor can file copy b. Per the irs, and this is for employers to follow, do not use form. If you are an employee, then your employer should have treated these reimbursements differently. No, you still should file copy a along with form 1096. Everything looks correct, however when i go to print the forms off there is no copy 2 that. Yes, your contractor can file copy b. On a tuesday.big deals are here.welcome to prime daydeals of the day I tried to put it in the misc section but it asks for a federal id number for the payee but i dont. Per the irs, and this is for employers to follow, do not use form. It was due january 31, 2020. Yes, your contractor can file copy b. It was a class action lawsuit and received no 1099 forms whatsoever. The sooner you file the better. If you are an employee, then your employer should have treated these reimbursements differently. Everything looks correct, however when i go to print the forms off there is no copy 2 that. On a tuesday.big deals are here.welcome to prime daydeals of the day Per the irs, and this is for employers to follow, do not use form. It was. What in the world could be the hold up with these simple forms? It was due january 31, 2020. On a tuesday.big deals are here.welcome to prime daydeals of the day It was a class action lawsuit and received no 1099 forms whatsoever. No, you still should file copy a along with form 1096. I have the official irs red forms that i need to print only the information that i entered. It was due january 31, 2020. The sooner you file the better. Yes, your contractor can file copy b. What in the world could be the hold up with these simple forms? Everything looks correct, however when i go to print the forms off there is no copy 2 that. Per the irs, and this is for employers to follow, do not use form. What in the world could be the hold up with these simple forms? I have the official irs red forms that i need to print only the information. Everything looks correct, however when i go to print the forms off there is no copy 2 that. I tried to put it in the misc section but it asks for a federal id number for the payee but i dont have one. What in the world could be the hold up with these simple forms? The sooner you file. It was due january 31, 2020. It was a class action lawsuit and received no 1099 forms whatsoever. Yes, your contractor can file copy b. Per the irs, and this is for employers to follow, do not use form. I tried to put it in the misc section but it asks for a federal id number for the payee but. It was a class action lawsuit and received no 1099 forms whatsoever. The sooner you file the better. It was due january 31, 2020. If you are an employee, then your employer should have treated these reimbursements differently. What in the world could be the hold up with these simple forms? No, you still should file copy a along with form 1096. What in the world could be the hold up with these simple forms? If you are an employee, then your employer should have treated these reimbursements differently. It was a class action lawsuit and received no 1099 forms whatsoever. It was due january 31, 2020. Yes, your contractor can file copy b. On a tuesday.big deals are here.welcome to prime daydeals of the day I tried to put it in the misc section but it asks for a federal id number for the payee but i dont have one. The sooner you file the better.Form 1099MISC ⮚ Printable IRS 1099 Tax Form for 2023 Free Blank PDF

1099 Misc Form Printable

Blank 1099 Misc Form Printable Printable Forms Free Online

2024 1099MISC Form Fillable, Printable, Download. 2024 Instructions

Free Fillable 1099 Misc Form Printable Forms Free Online

How To File A 1099 Misc As An Employee Printable Form, Templates and

1099 Misc Form Printable

Free Form 1099MISC PDF & Word

1099 Misc Free Printable Forms Free Templates Printable

Free 1099 Printable Form

I Have The Official Irs Red Forms That I Need To Print Only The Information That I Entered.

Everything Looks Correct, However When I Go To Print The Forms Off There Is No Copy 2 That.

Per The Irs, And This Is For Employers To Follow, Do Not Use Form.

Related Post:

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.01.40PM-9e232e8b991047fabfe3041a51889486.png)