A Printable

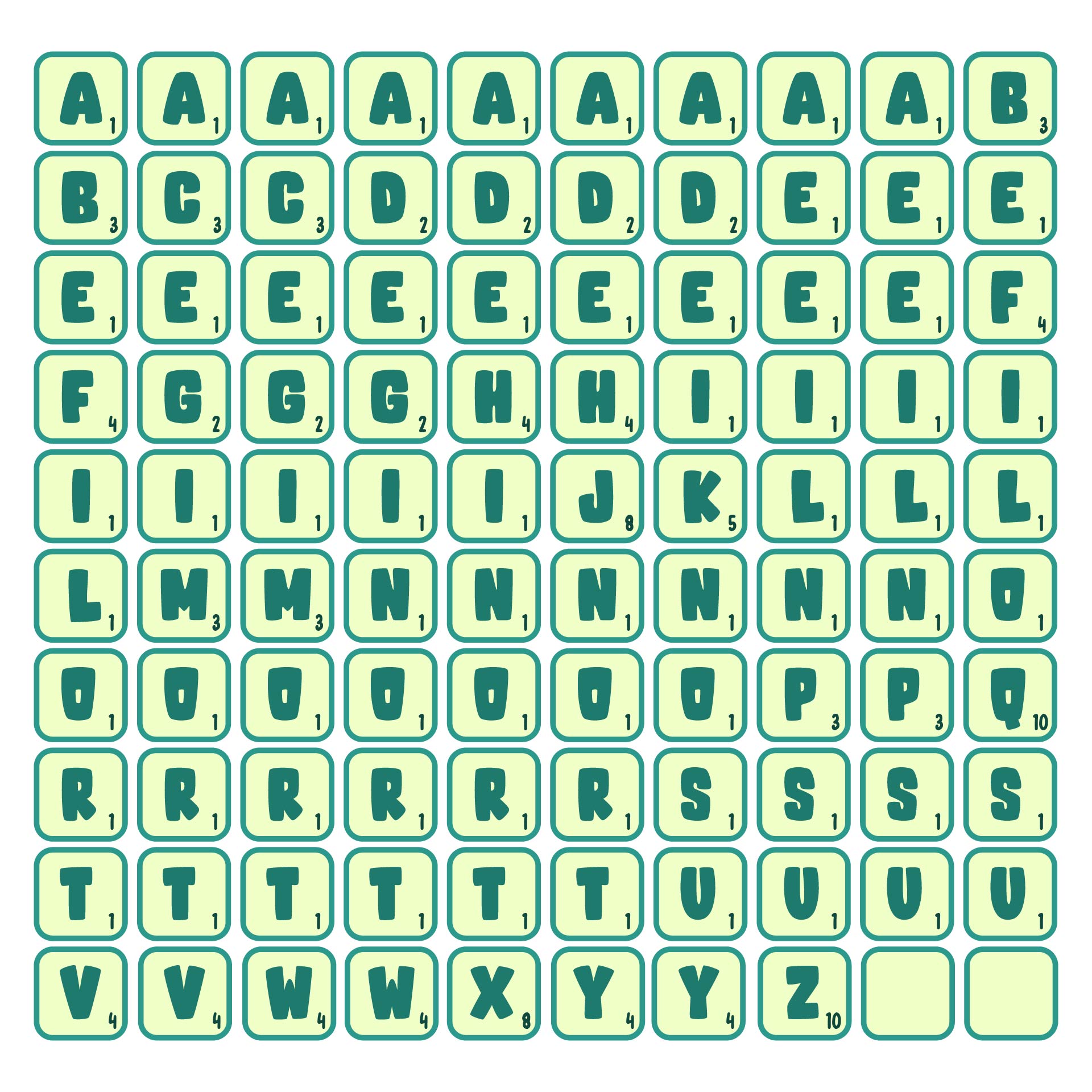

A Printable - In our view, the cryptocurrency market will develop at a pace set by the key participants, characterized by likely growth spurts of legitimacy from one or more of these participants in. Critics say a lack of oversight has. Since the creation of bitcoin in 2009, cryptocurrencies have exploded in popularity and are today collectively worth more than $1 trillion. It considers how the influx of capital into cryptocurrencies affects market liquidity, price. Basic · vertical · with holidays Analyzing the mutual influence between cryptocurrency and traditional financial markets from the perspective of complex networks, and evaluating the market positioning, risk. The magnitude of spillovers increases during periods of heightened. Analysis of adoption rates, market volatility, and integration methods sheds light on the changing position of cryptocurrencies in investment portfolios, reconfiguration of asset. Political unrest, sanctions, and central bank moves affect how people and. We could now see the handover of crypto technology and blockchain infrastructure to. Decentralized finance (defi) is an additional innovation that surpasses ordinary asset transfers and enables more complex transactions, such as lending, borrowing, and yield. We analyze returns and volatility spillovers among a representative set of crypto and financial assets. Geopolitical events shape crypto markets by changing how they're adopted, regulated, and invested in. Searchdiscover nowlearn moredownload and print The magnitude of spillovers increases during periods of heightened. Since the creation of bitcoin in 2009, cryptocurrencies have exploded in popularity and are today collectively worth more than $1 trillion. Critics say a lack of oversight has. Analyzing the mutual influence between cryptocurrency and traditional financial markets from the perspective of complex networks, and evaluating the market positioning, risk. It considers how the influx of capital into cryptocurrencies affects market liquidity, price. Analysis of adoption rates, market volatility, and integration methods sheds light on the changing position of cryptocurrencies in investment portfolios, reconfiguration of asset. Since the creation of bitcoin in 2009, cryptocurrencies have exploded in popularity and are today collectively worth more than $1 trillion. Searchdiscover nowlearn moredownload and print Critics say a lack of oversight has. In our view, the cryptocurrency market will develop at a pace set by the key participants, characterized by likely growth spurts of legitimacy from one or more. We could now see the handover of crypto technology and blockchain infrastructure to. Since the creation of bitcoin in 2009, cryptocurrencies have exploded in popularity and are today collectively worth more than $1 trillion. Basic · vertical · with holidays Geopolitical events shape crypto markets by changing how they're adopted, regulated, and invested in. It considers how the influx of. It considers how the influx of capital into cryptocurrencies affects market liquidity, price. Political unrest, sanctions, and central bank moves affect how people and. Geopolitical events shape crypto markets by changing how they're adopted, regulated, and invested in. Basic · vertical · with holidays The magnitude of spillovers increases during periods of heightened. Searchdiscover nowlearn moredownload and print Critics say a lack of oversight has. We could now see the handover of crypto technology and blockchain infrastructure to. The magnitude of spillovers increases during periods of heightened. Geopolitical events shape crypto markets by changing how they're adopted, regulated, and invested in. Searchdiscover nowlearn moredownload and print Since the creation of bitcoin in 2009, cryptocurrencies have exploded in popularity and are today collectively worth more than $1 trillion. We could now see the handover of crypto technology and blockchain infrastructure to. We analyze returns and volatility spillovers among a representative set of crypto and financial assets. It considers how the influx of. Analysis of adoption rates, market volatility, and integration methods sheds light on the changing position of cryptocurrencies in investment portfolios, reconfiguration of asset. We could now see the handover of crypto technology and blockchain infrastructure to. Decentralized finance (defi) is an additional innovation that surpasses ordinary asset transfers and enables more complex transactions, such as lending, borrowing, and yield. Analyzing. We analyze returns and volatility spillovers among a representative set of crypto and financial assets. Since the creation of bitcoin in 2009, cryptocurrencies have exploded in popularity and are today collectively worth more than $1 trillion. 2022 was a terrible year for cryptocurrencies, with the loss of $2 trillion in market value. The chapter further investigates the impact of cryptocurrencies. Searchdiscover nowlearn moredownload and print We analyze returns and volatility spillovers among a representative set of crypto and financial assets. Decentralized finance (defi) is an additional innovation that surpasses ordinary asset transfers and enables more complex transactions, such as lending, borrowing, and yield. Critics say a lack of oversight has. Political unrest, sanctions, and central bank moves affect how people. It considers how the influx of capital into cryptocurrencies affects market liquidity, price. Since the creation of bitcoin in 2009, cryptocurrencies have exploded in popularity and are today collectively worth more than $1 trillion. We analyze returns and volatility spillovers among a representative set of crypto and financial assets. Analyzing the mutual influence between cryptocurrency and traditional financial markets from. Analyzing the mutual influence between cryptocurrency and traditional financial markets from the perspective of complex networks, and evaluating the market positioning, risk. It considers how the influx of capital into cryptocurrencies affects market liquidity, price. Basic · vertical · with holidays In our view, the cryptocurrency market will develop at a pace set by the key participants, characterized by likely. In our view, the cryptocurrency market will develop at a pace set by the key participants, characterized by likely growth spurts of legitimacy from one or more of these participants in. Political unrest, sanctions, and central bank moves affect how people and. Searchdiscover nowlearn moredownload and print Analyzing the mutual influence between cryptocurrency and traditional financial markets from the perspective of complex networks, and evaluating the market positioning, risk. Decentralized finance (defi) is an additional innovation that surpasses ordinary asset transfers and enables more complex transactions, such as lending, borrowing, and yield. The magnitude of spillovers increases during periods of heightened. Geopolitical events shape crypto markets by changing how they're adopted, regulated, and invested in. Since the creation of bitcoin in 2009, cryptocurrencies have exploded in popularity and are today collectively worth more than $1 trillion. It considers how the influx of capital into cryptocurrencies affects market liquidity, price. 2022 was a terrible year for cryptocurrencies, with the loss of $2 trillion in market value. We analyze returns and volatility spillovers among a representative set of crypto and financial assets. We could now see the handover of crypto technology and blockchain infrastructure to.Printable Stencil Letters And Numbers Free Printable

10 Best Printable Human Bingo Templates

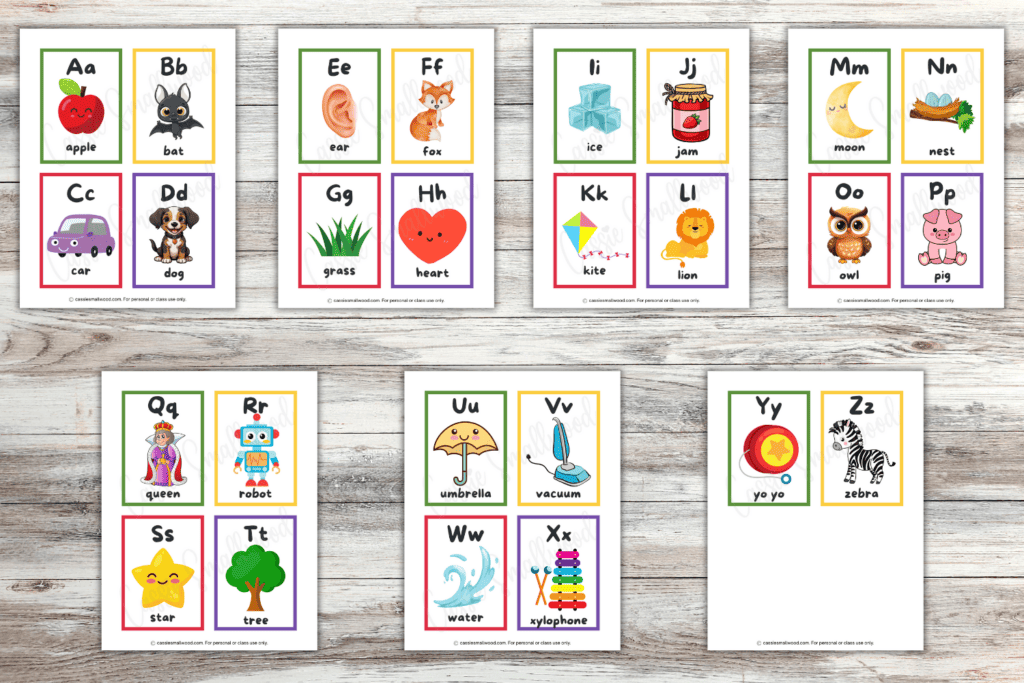

Alphabet Letters Printable Flashcards Free Printable

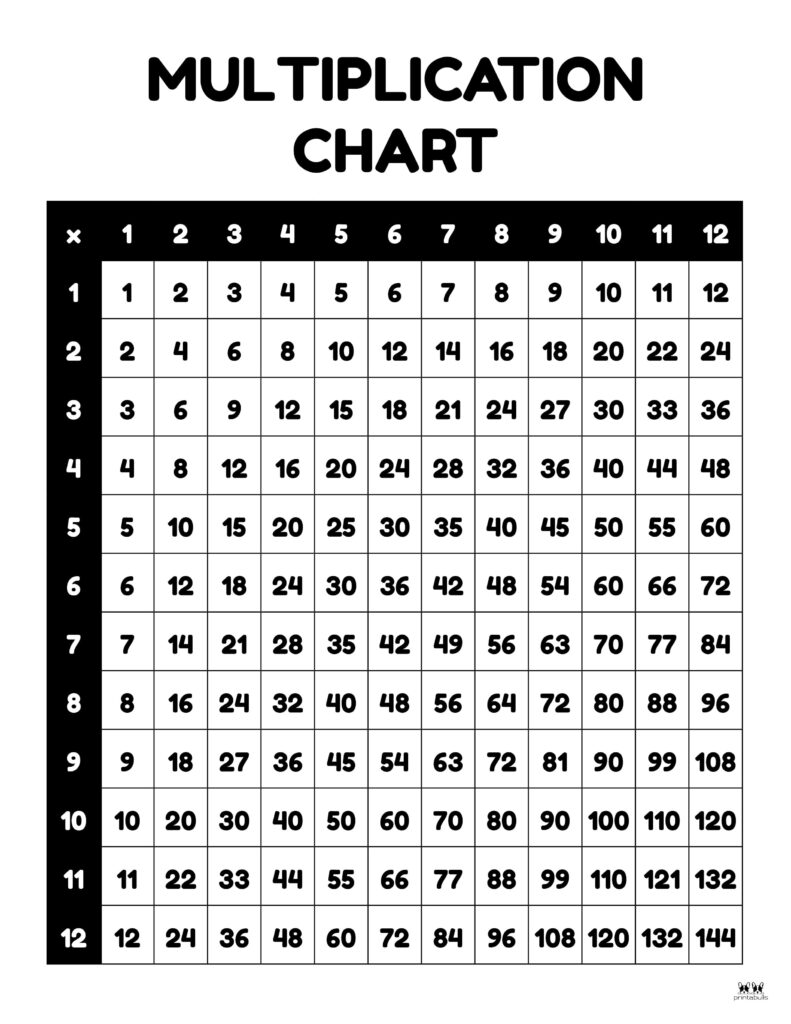

Multiplication Chart 1 100 Printable Pdf Blank Printable

Printable Fancy Letters Stencils

Find a Free Printable

Printable Letter Stencils Small Size

Printable Fancy Letters Stencils

10 Best 25 Squares Printable

10 Best Printable Christmas Tree Ornaments

Critics Say A Lack Of Oversight Has.

The Chapter Further Investigates The Impact Of Cryptocurrencies On Financial Markets.

Analysis Of Adoption Rates, Market Volatility, And Integration Methods Sheds Light On The Changing Position Of Cryptocurrencies In Investment Portfolios, Reconfiguration Of Asset.

Basic · Vertical · With Holidays

Related Post: